DON"T JUST JUMP INTO A SHORT SALE.. .

Selling your house for less than the value of the mortgage (short sale) will not restore your damaged credit. Some realtors (not all) like to glamorize short sales as being better for your credit than a foreclosure, this is NOT true, but in fact as far as the hit you will take credit wise it will be very similar.

AND It will not necessarily let you off the hook for the balance that you owe on the mortgage once your bank has received proceeds from the sale. In some states the bank can try to collect the difference for up to six years.

Also known as a deficiency judgment, which will be reflected on your credit report. If your state won’t allow a deficiency judgment to go on your credit report you still will take the drastic credit hit or drop that is the same or similar to a foreclosure.

Finally you may go through the wrenching emotional decision to sell your home for less than what you owe (short sale), and then the bank, which has final word on whether or not they will accept the short sale offer, can take so long that the deal will fall apart or they can reject the short sale period.

You will have turned your life and your family’s upside down for no apparent good reason.

Okay. You’ve been told or given advice by a realtor or even your lender that perhaps a short sale of your home is really the best option. It could be, depending on what your game plan is. Of course most realtors (but not all) will offer this as the only and best option, however a short sale will have the same credit score impact as if you had a foreclosure. Most realtors will not tell you this upfront but the knowledgeable and honest ones will. After all realtors need business too, but it should not be to their benefit only and to your detriment.

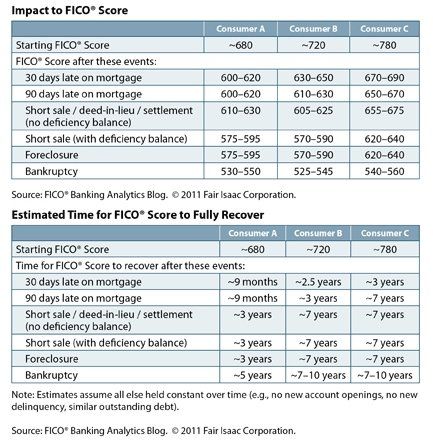

There is actually a study done by guess who? Fair Issac Corporation. That's right the FICO guys themselves. The ones who make credit scores. No opinions just facts. Put together and sourced by FICO.

Their own study showed that there is a minimal difference on a credit score between a short sale and foreclosure. That's right. Those who had a higher credit score had a greater credit drop and even took longer to recover in some cases! Take a look at the graphic below.

The FICO people themselves show that Short sale vs Foreclosure is very similar on your credit score!

So...remember the credit score is essentially the same with either.

Of course there are advantages of a short sale versus a foreclosure. You can possibly recover and buy quicker if you short sale rather than foreclose. A short sale also looks better on your credit report than a foreclosure does especially when it comes to employment and appearing responsible because you did not walk away and foreclose you opted for a short sale instead. So a short sale MAY be a better option for some.

With all the above said is there a better option, alternative or solution other than a short sale? Yes. There is.

Have to sell your underwater/upside down home but can’t?

The whole problem with being underwater or upside down in your mortgage and home is that it’s only a problem if you absolutely have to sell either because you must move or relocate, down size, upsize, can no longer afford the mortgage payments and can’t get a modification of the mortgage loan, or can’t refinance because of negative equity.

You now have a better understanding of a Short Sale option.

If you really understand this option and realize that it may not be for you then consider the Mortgage Payments Relief Program.

Immediate Homeowner Mortgage Relief.....Right Now! We take over...you move on.

Call (623) 738-4398 today! You can also email for more information here: Info@HomeownersReliefProgram.com