Have no choice but to walk away from your home and mortgage?

Is There An Upside down or Underwater Home and Mortgage Solution, Option or Alternative?

How Can I Get Out Of An Upside down Or Underwater Home And Mortgage?

Is there really an upside down or underwater home and mortgage solution? Yes there is.

Why simply succumb to economic default (unintentional foreclosure) or strategic default (intentional foreclosure) where the result will be the same?

The Homeowners Relief Program offers homeowners in either mortgage situation, (economic default or strategic default) the ability to get out of the situation and to lessen the impact of either type of default.

https://www.homeownersreliefoptions.com/Mortgage-Payments-Relief-Program

Here we are about to enter into the second half of 2022. The current economic environment is certainly unprecedented in our lifetime. There's lot's of uncertainty.

Many homeowners are intentionally defaulting on mortgage payments known as a strategic default (which is not a good idea because now they are going after these types of defaulters) because of upside down and underwater mortgages that they simply can't get out of.

Not just because they just can't make the payments (for some this is a reality) but because they feel that financially and economically it does not make sense to throw good money after bad.

After all why continue to put money in a bad investment? Banks walk away from bad investments all the time. So do Wall street investors. Why can't homeowners? You can. Read on...

Well homeowners who are financially savvy are walking away from bad mortgages in droves. Many are willing to take the temporary hit on their credit and simply prepare before they walk away from the mortgage and property attached to it. The banks and lenders are now engaged in campaigns to make these homeowners feel guilty or afraid to walk away from a bad investment.

However it makes sense not to put anymore money into an investment gone bad or cannot give any return at all. You won't go to jail for breaking your mortgage contract. Just like a car repossession it shows up on your credit report and life goes on. Doesn't mean you should do this though.

The question is, is there a way to walk away from your mortgage without risking your credit or taking the credit hit? Yes there is. The Homeowners Relief Program via Homeowners Relief Options Inc.

So there's the question of, is this the solution to simply walking away from a bad mortgage situation such as an upside down or underwater mortgage or because of an unforeseen economic situation such as severe reduction of income, unemployment, divorce, etc.?

It may possibly be. It is an alternative where none existed before

Homeowners Relief Options Inc. has been offering homeowners this type of upside down mortgage solution for over 20 years now.

Instead of just simply succumbing to economic default (unintentional foreclosure) or strategic default (intentional foreclosure) where the result will be the same, the Homeowners Relief Program offered by Homeowners Relief Options Inc. offers home owners in a bad mortgage situation, (ie: underwater mortgage or upside down mortgage,) the ability to get out of this situation and to lessen the impact of either type of default. How do we take over your upside down mortgage payments and you move on?

Okay, taking over the home and mortgage payments. Lenders and banks do not care who pays the mortgage or where the monthly payment comes from just as long as it gets paid.

All we ask is simply this, allow us to get authorization from you to send to your lender or bank notifying them that the future monthly payments will be coming from us and to send all notices, request for payments, etc to us.

You'll also be required to sign over the property to our trustee and record the new ownership in your local county recorder's office in your local city where the property is. After all we would like to own the property the mortgage is being paid on.

It makes sense to at least look at the some of the benefits of the Homeowners Relief Program before simply walking away, foreclosing and taking the credit hit. Why take the credit hit when you don't have to?

Even if you are willing to take it and your credit rating is already bad it will give you the time needed to get another home to possibly buy or at least rent for probably much less than you are paying now. Not to mention the immediate financial relief of having that former mortgage payment stay in your bank account or pockets to do as you please to get yourself some stability financially again.

Why throw good money after bad? Let Homeowner Relief Options Inc. take over that upside down or underwater home and mortgage. This is what we do.

That monthly mortgage will get paid until we can satisfy the total amount of the mortgage. We may be able to sell the property when the market conditions allow. Can or will your realtor pay your monthly mortgage note until your house sells? No, but we can, Via the Homeowners Relief Program.

We are real estate investors. This is what we do. We help take over homes and mortgage payments so people can move on with their lives.

Short sale? Okay. You have been told that perhaps a short sale of your home is really the best option. It could be, depending on what your game plan is.

Of course most realtors (not all) will offer this as the only and best option, however a short sale of your home will have the same credit score impact as if you had a foreclosure.

After all realtors need business too. Most realtors will not tell you this upfront but the knowledgeable and honest ones will.

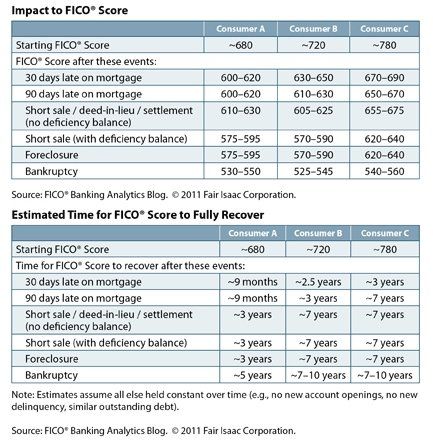

There is a study done by guess who? Fair Issac Corporation. That's right the FICO guys themselves. The ones who make credit scores. No opinions just facts. Put together and sourced by FICO. Their own study showed that there is a minimal difference on a credit score between a short sale and foreclosure. That's right. Those who had a higher credit score had a greater credit drop and even took longer to recover in some cases! Take a look at the graph below:

The FICO people themselves show that Short sale vs Foreclosure is very similar on your credit score! So...remember the credit score is essentially the same with either.

The advantage of short sale vs foreclosure is:

1. You can recover and buy quicker if you short sale rather than foreclose

2. It short sale looks better on your report than foreclosure especially when it comes to things like future employment and responsibility. You resolved it with a short sale rather than just walk away and foreclose.

However...

A short sale may be a better option for some. However there is another option and alternative. You can avoid both short sale and foreclosure. It's your choice. Let Homeowner Relief Options Inc. take over your upside down or unmanageable mortgage payment. We'll take over your home and mortgage payment and you can move on.

Imagine struggling to make mortgage payments on a home you no longer can afford or simply don't want to afford for what ever reason. That payment of lets say for example $1200 per month is now an extra $1200 that you can now use to relieve financial stress by paying some bills, putting towards a new residence, buying a car, etc. Now every month you have an extra $1200 to do as you please. Except the payment of $1200 mortgage payment is being paid monthly via the Homeowner Relief program . Not by you!

So Yes. There is a solution, option or alternative for upside down or underwater mortgages and homes.

Call or email Homeowners Relief Options today!

(602) 738-4398 or Email: Info@HomeownersReliefProgram.com

Download a > PDF Home Fact Form here < or > WORD Home Fact Form here <--- and email or fax it back to us and we'll contact you within 72 hours. As you can imagine we are very busy so please be patient.

Check out Homeowners Relief Solutions "Homeowners Relief Program" here:

https://www.homeownersreliefoptions.com/Mortgage-Payments-Relief-Program

Check out the benefits of the Homeowners Relief Program here:

https://www.homeownersreliefoptions.com/program-benefits

Some questions? We've got answers here:

https://www.homeownersreliefoptions.com/Questions-and-Answers

More Questions? Email to: Info@HomeownersReliefProgram.com

And Yes! We are Nationwide.

by C. Lenet t

How can I get out of an underwater or upside down mortgage?

http://overleveraged-upside-down-underwater.blogspot.com/

How to walk away from a mortgage and survive

http://walk-away-from-mortgage-and-survive.blogspot.com/

Is there an upside to an upside down mortgage?

http://isthereanupsidetoanupsidedownmortgage.blogspot.com

Can I turn my home over to a company and walk away?

http://caniturnovermyunderwatermortgagehome.blogspot.com

What can I do with my upside down mortgage?